Make a difference! Join us April 26th & 27th for our 2024 Community Impact Project. Learn More ▶

Make a difference! Join us April 26th & 27th for our 2024 Community Impact Project. Learn More ▶

![]()

Our in-house, fee-only investment management deeply integrates with your Financial LifePlan, designing your portfolio to support what matters most: your values, goals, and peace of mind.

Time-Tested & Objective

We construct your portfolio using time-tested principles and provide an objective perspective to help you avoid the pitfalls of emotional investing. We don’t receive commissions on anything we recommend, so you know we’re always acting in your best interest.

Values Aligned

Investing for a return no longer means needing to turn a blind eye to what you’re investing in. We offer a variety of values-based and impact investment options so you can align your portfolio with your passions and convictions.

Actively Monitored

We monitor market conditions and your investments so you don’t have to. We respond opportunistically to material market swings by utilizing progression strategies that go beyond the typical “buy and hold”.

![]()

Investments don’t need to be flashy; they need to work. It’s important that you understand and believe in your strategy to navigate the inevitable ups and downs. We take a highly analytical yet accessible approach to designing your portfolio. We’ve developed our strategies by analyzing financial markets, investor behavior, and investment theory.

![]()

It’s important to base your faith and contentment in something other than investment accounts. The best investors have a sense of confidence that goes beyond their success as investors. As 1 Timothy tells us, our trust is best placed in God rather than our money. When we’re able to give money the proper place in our hearts and lives, it minimizes the temptation to make rash, emotionally-driven decisions—making us better, less anxious investors.

It’s important to base your faith and contentment in something other than investment accounts. The best investors have a sense of confidence that goes beyond their success as investors. As 1 Timothy tells us, our trust is best placed in God rather than our money. When we’re able to give money the proper place in our hearts and lives, it minimizes the temptation to make rash, emotionally-driven decisions—making us better, less anxious investors.

Successful investors start with clearly defined goals and values and then select appropriate strategies and investments accordingly. We offer a variety of values-based and impact investment options—including Biblically Responsible Investing (BRI) and Socially Responsible Investing (SRI)—that address the multiple time horizons and growth objectives outlined in your Financial LifePlan.

Successful investors start with clearly defined goals and values and then select appropriate strategies and investments accordingly. We offer a variety of values-based and impact investment options—including Biblically Responsible Investing (BRI) and Socially Responsible Investing (SRI)—that address the multiple time horizons and growth objectives outlined in your Financial LifePlan.

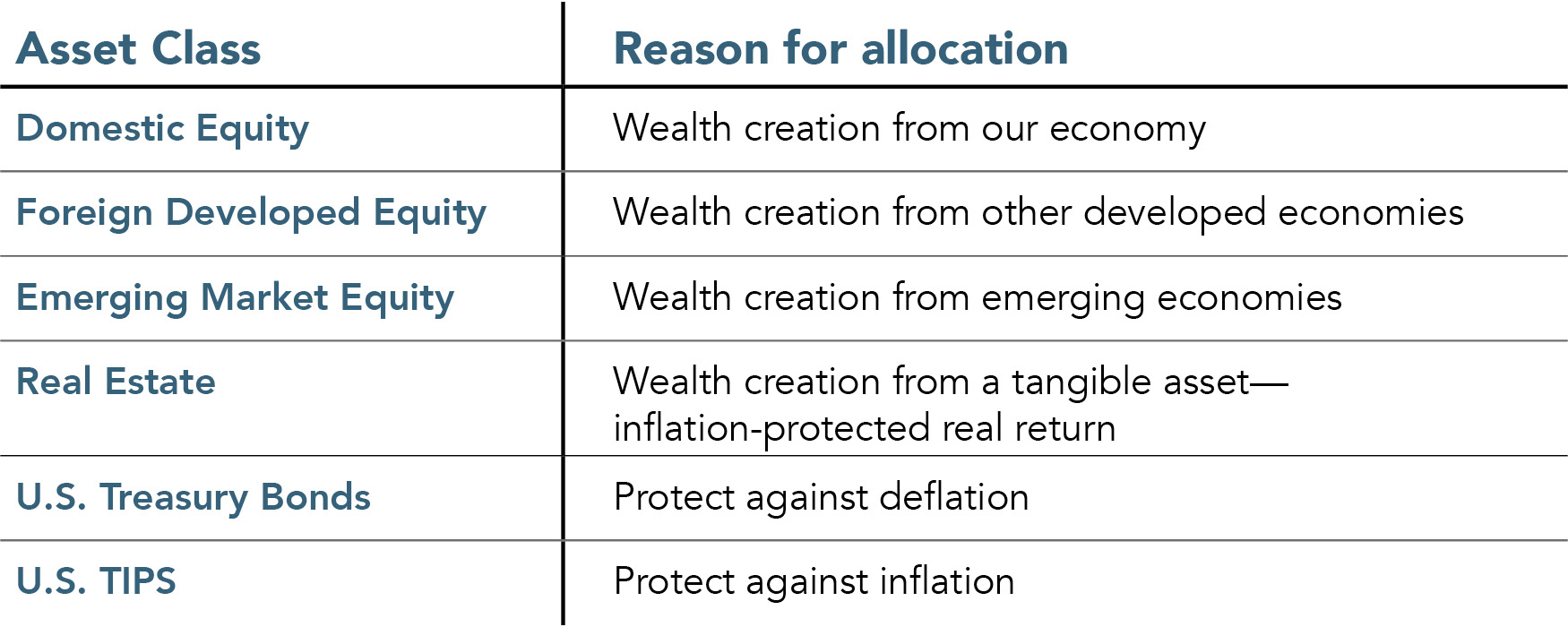

As affirmed in Ecclesiastes 11, meaningful diversification is important because no one knows what tomorrow will bring. Many portfolios consist primarily of U.S. stocks and bonds, leaving them devoid of true diversity. This is because stocks and bonds can be similarly affected by the same economic factors, such as U.S. monetary policy and interest rates. In order to truly reap the benefits of diversification, we first determine the opportunities we’re trying to benefit from and the risks we’re trying to avoid. Then, we select investments to meet those specific objectives (e.g., one investment may be held for the purpose of growth and another to reduce inflation risk). Our portfolios broaden the traditional asset class exposure and employ an atypical allocation to provide more meaningful diversification.

As affirmed in Ecclesiastes 11, meaningful diversification is important because no one knows what tomorrow will bring. Many portfolios consist primarily of U.S. stocks and bonds, leaving them devoid of true diversity. This is because stocks and bonds can be similarly affected by the same economic factors, such as U.S. monetary policy and interest rates. In order to truly reap the benefits of diversification, we first determine the opportunities we’re trying to benefit from and the risks we’re trying to avoid. Then, we select investments to meet those specific objectives (e.g., one investment may be held for the purpose of growth and another to reduce inflation risk). Our portfolios broaden the traditional asset class exposure and employ an atypical allocation to provide more meaningful diversification.

Fees directly reduce real return. Our portfolios utilize low-cost investments to minimize fees. In instances where we employ active managers, we carefully and regularly analyze performance to ensure that managers are earning their keep.

Fees directly reduce real return. Our portfolios utilize low-cost investments to minimize fees. In instances where we employ active managers, we carefully and regularly analyze performance to ensure that managers are earning their keep.

The amount paid in taxes reduces the amount of return you keep. “Turnover”—the amount of buying and selling in an account—can increase the amount of capital gains tax. Our portfolios aim to reduce turnover and enable us the opportunity to “harvest” gains or losses depending on your asset level and tax situation. When appropriate, we place different types of investments in tax-qualified accounts (versus non-tax-qualified accounts) to minimize taxes.

The amount paid in taxes reduces the amount of return you keep. “Turnover”—the amount of buying and selling in an account—can increase the amount of capital gains tax. Our portfolios aim to reduce turnover and enable us the opportunity to “harvest” gains or losses depending on your asset level and tax situation. When appropriate, we place different types of investments in tax-qualified accounts (versus non-tax-qualified accounts) to minimize taxes.

Throughout human history, people have been concerned with future uncertainty. Yet in order to have an opportunity to reap market returns, they have had to step out in faith and “plant” anyway. In fact, investors with the discipline to go against popular opinion and sell investments after they go up (i.e., sell high) and buy investments when they are at a discount (i.e., buy low) tend to win over the long term. Our portfolios regularly and systematically sell investments that have gone up and buy investments that have gone down.

Throughout human history, people have been concerned with future uncertainty. Yet in order to have an opportunity to reap market returns, they have had to step out in faith and “plant” anyway. In fact, investors with the discipline to go against popular opinion and sell investments after they go up (i.e., sell high) and buy investments when they are at a discount (i.e., buy low) tend to win over the long term. Our portfolios regularly and systematically sell investments that have gone up and buy investments that have gone down.

Many studies have shown that it’s difficult to find a money manager who consistently delivers risk- and fee-adjusted returns superior to the market over the long term. This becomes especially difficult in efficient markets where there aren’t many bargains to be found. Usually, buying the market through low-cost, passively managed funds can deliver a better result. In some markets, however, it can pay to use active managers to take advantage of market conditions and find undervalued investment opportunities. We seek to utilize the strengths of both active and passive management. You will only pay for active management where it’s likely to be helpful.

Many studies have shown that it’s difficult to find a money manager who consistently delivers risk- and fee-adjusted returns superior to the market over the long term. This becomes especially difficult in efficient markets where there aren’t many bargains to be found. Usually, buying the market through low-cost, passively managed funds can deliver a better result. In some markets, however, it can pay to use active managers to take advantage of market conditions and find undervalued investment opportunities. We seek to utilize the strengths of both active and passive management. You will only pay for active management where it’s likely to be helpful.

Greed and fear are primary enemies of investor success. The reality is that your portfolio’s overall performance will neither be as high as its best-performing asset class, nor as low as its worst—it will be a blend of all individual returns. To maximize your chances of long-term success, it’s important to establish and maintain realistic expectations so you can effectively navigate the market’s inevitable ups and downs.

Greed and fear are primary enemies of investor success. The reality is that your portfolio’s overall performance will neither be as high as its best-performing asset class, nor as low as its worst—it will be a blend of all individual returns. To maximize your chances of long-term success, it’s important to establish and maintain realistic expectations so you can effectively navigate the market’s inevitable ups and downs.

![]()

We strongly believe in the concept of meaningful diversification, especially when combined with our bucketing and dynamic rebalancing processes. We generally invest in the following asset classes:

We utilize investment bucketing, also known as “time-based segmentation”, to divide your money based on your spending needs (as determined by your Financial LifePlan):

We select a proper investment type for each bucket and then monitor and refill them periodically to maintain appropriate levels. Matching up investments with an appropriate time horizon reduces risk.

We’ve also found that it helps our clients stay invested through down markets. It is comforting to know you have several years worth of withdrawals that are not in the stock market.

Absolutely!

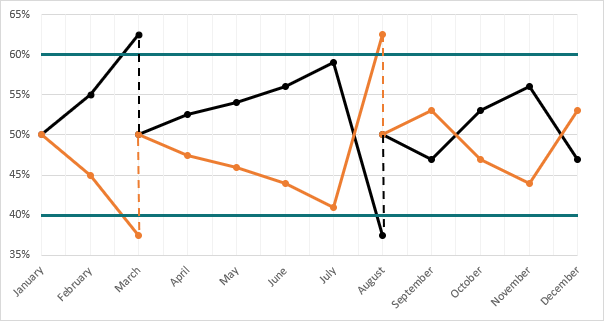

We employ a dynamic rebalancing process where we establish allocation targets and drift collars for each position in our portfolios, based on your specific investments and risk profile. We review accounts regularly for rebalancing opportunities and trade positions back to their targets when they surpass their drift collars.

Dynamic rebalancing allows us to take advantage of short- and long-term market trends by systematically selling high and buying low.

We do not know (nor does anyone know!) when the next drop will come, how long it will last, or how severe it may be. However, just like the proverbial “death and taxes”, we can be confident that we will experience another drop at some point in the future.

In addition to our dynamic rebalancing process explained in the question above, we employ our Buy-the-Dip Progression (BDP) and Sell-the-Recovery Progression (SRP) strategies to respond to large market drops.

At their core, our BDP and SRP strategies are built on the primary assumption that stocks will continue to go up over the long term, even though they experience periods of decline. If stock prices will presumably trend up over the long term, it does not make sense to attempt to predictably time the top.

It does, however, make sense to systematically anticipate the bottom.

If we believe the stock market will continue to increase over the long term, we must also believe that stock prices ultimately have a floor during periods of decline. Therefore, should the market dip, our BDP/ SRP strategies aim to temporarily increase stock allocations in steps at predetermined market levels on the way down (i.e., “buy the dip”). Buying at discounted levels gives us the opportunity to sell back these overweight stock positions on the way up (i.e., “sell the recovery”), ideally at a profit.

Planning and investment management are fundamentally linked. In order for us to know what to do with your money, we need to know what your money needs to do for you. Your plan lays out the “why” and “what,” while your investment strategy defines your “how” and “when”.

Your plan:

Knowing what your portfolio needs to provide over time also lays the foundation for two of our key investing strategies:

1. Portfolio Design

2. Account Administration, Oversight, & Trading

3. Communication, Advisor, Account Access

4. Tactical Response to Market Changes

5. Tax Efficiency

We believe there is merit to active and passive management. They both can work. In fact, they each work because of the other.

If markets weren’t efficient, passive management wouldn’t work. Active management makes markets efficient. Conversely, if markets weren’t inefficient, active management wouldn’t work. Passive management makes markets inefficient. We also believe in the middle ground of starting with the index and “scientifically” overweighting and underweighting areas of the index likely to outperform.

We believe pure passive management (index-based) is the easiest way to prevent underperformance and avoid manager risk. Passive management should be used if there isn’t a high confidence level in an active manager.

We also know that investor behavior has an impact on investor outcomes. Good investor behavior is easier to achieve if the investor believes in their investment style. If investors lose confidence when things get shaky, they will likely sell at the wrong time (when things are down) and sabotage their long-term results.

Our investment team has developed both passive and active portfolios we are confident will align with your investing views and deliver the outcomes you need. Your advisor will help you choose and tailor one you can believe in so that you can stick with it through the inevitable ups and downs of the market.

Yes. Our investment team, led by Zak Lutz CFP®, RLP®, CKA®, Chief Investment Officer, has developed our values-based investing approach and portfolio options. We believe it is our job to help you build your personal investing convictions and provide you with quality options that match your values. We provide portfolio options across the values-based spectrum below.

It’s not about our convictions, it’s about yours. We will help you choose the portfolio that is right for you.

Yes, we offer multiple investing styles focused solely on maximizing shareholder (investor) value.

We have been working with LifeGuide for over three years and have always had positive experiences. The team members are all pleasant and on top of changes in the financial world. We are comfortable that they manage our account with integrity and expertise.As posted in Barry's Google Review

The presented testimonial is from a current LifeGuide Financial Advisors client and was obtained via a third-party website. LifeGuide Financial Advisors reached out to a random sample of clients requesting voluntary feedback. Clients were not provided any compensation with respect to said testimonials. The testimonial provided is for informational purposes only and is not representative of all client experiences, which may differ substantially. Click here to view all the testimonials received by LifeGuide Financial Advisors on Google My Business.