April 26, 2021 | Investing

Today, we’re sitting down with LifeGuide Partner and Chief Investment Officer, Zak Lutz, to answer some of the most frequently asked questions we receive. This is the final part in our six-part Q&A series.

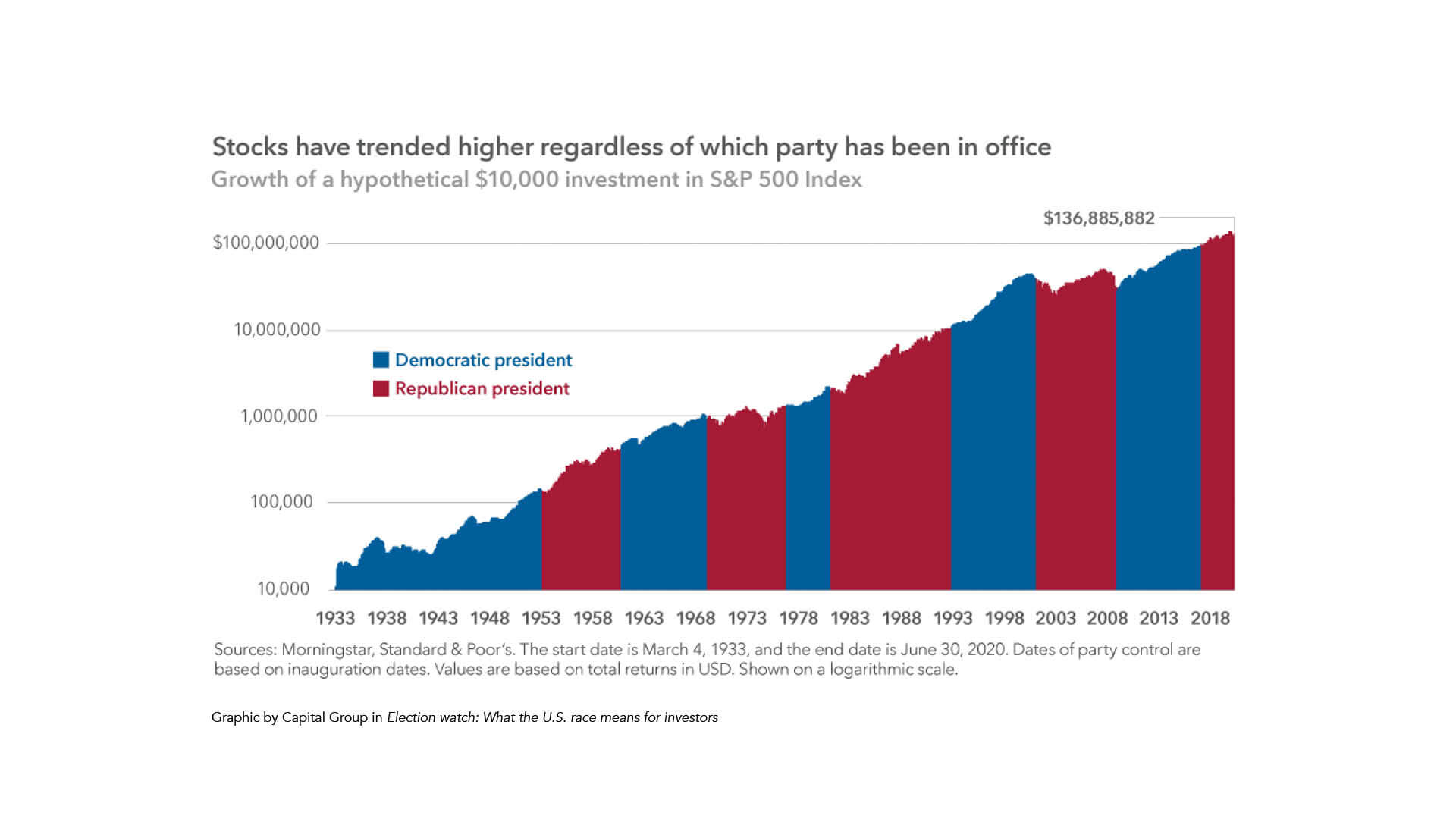

In it, we discussed that, had you invested $10,000 into US stocks in 1933 and kept it invested through these “unprecedented” events that have occurred, you would walk away with $136,885,882 today (“today” being June 30, 2020)—nearly a fourteen-thousand-fold return on investment.

While we know that past performance is not a guarantee of future performance, it is a good example of how it’s possible for the market to keep increasing over time.

Another helpful realization is this: If the market grew in a straight line since 1933, we would have hit new highs every day and the experience of seeing new highs would be common.

The reality, though, is that the stock market zigs and zags. Because it doesn’t hit new highs every day, the highs can feel less common and therefore more uncomfortable. When the market does its normal “zigging” and “zagging” or hits a “record high,” media outlets drive viewership by invoking fear and anxiety.

In the short-term, the consensus expectations can be wrong, causing the market to move in unexpected ways. However, there is much evidence that supports having a confident outlook in the long-term growth and resiliency of the stock market.

For example, to paraphrase Warren Buffet, improvements in productivity and innovation are dynamics that have caused increasing wealth since the beginning of mankind and will continue.

This crisis has shown many examples of innovation and productivity at work. Times and technology grow and change and evolve, and humans consistently find new ways to innovate, create, and produce. As we do, it is possible for the market to keep increasing.

At the end of the day, most people want to know: “How should I handle this market?” The approach we use consistently here at LifeGuide is prepare, not predict.

While we all wish we had a crystal ball and could predict the future, that’s simply not a reality. Instead, we intentionally prepare for what the market could give us instead of trying to predict what the market is going to do. For example, having an allocation of Treasury Inflation-Protected Securities (TIPS) and real estate can position for inflation, bonds for the next correction, and stocks for growth and expansion.

As Ecclesiastes 11:2 and 11:6 reminds us, it is wise to not make too big of a bet on any particular outcome. The world is simply too complex to predict.

Bottom line: There is much evidence that supports having a confident outlook in the long-term growth and resiliency of the stock market. The approach we use consistently here at LifeGuide is prepare, not predict.