October 13, 2020 | Investing

Oh boy! Today, we’re diving in headfirst! That’s right. We’re talking about the upcoming presidential election in November!

More specifically, we want to ask: How should we be responding to this period of uncertainty? What effects might the election have on our portfolios?

Recently, LifeGuide managing partner, Doug Denlinger, sat down for a Zoom call with our newest Lead Financial Advisor, Brien Lasse—who, fun fact, worked for a time in the White House’s Office of Management and Budget—to examine the historical impacts elections have had on investment portfolios.

(Note that this video was adapted from a video originally produced for our monthly client newsletter, “Guidepost”)

Understandably, the upcoming U.S. presidential election has many people wondering what the future direction of our country will look like and how that future will affect their plans and portfolios.

These are weighty issues and can cause concern, uncertainty, and even fear. The political machines for both parties are certainly revved up and the 24/7 news cycle is spinning at a feverish pace, bombarding all of our devices from every direction.

A crystal ball would certainly come in handy right now! And while it’s tempting to try and predict November’s election outcome as well as its impact on the markets, the reality, of course, is that no one can predict what the Wall Street Journal headlines will read like on November 4th.

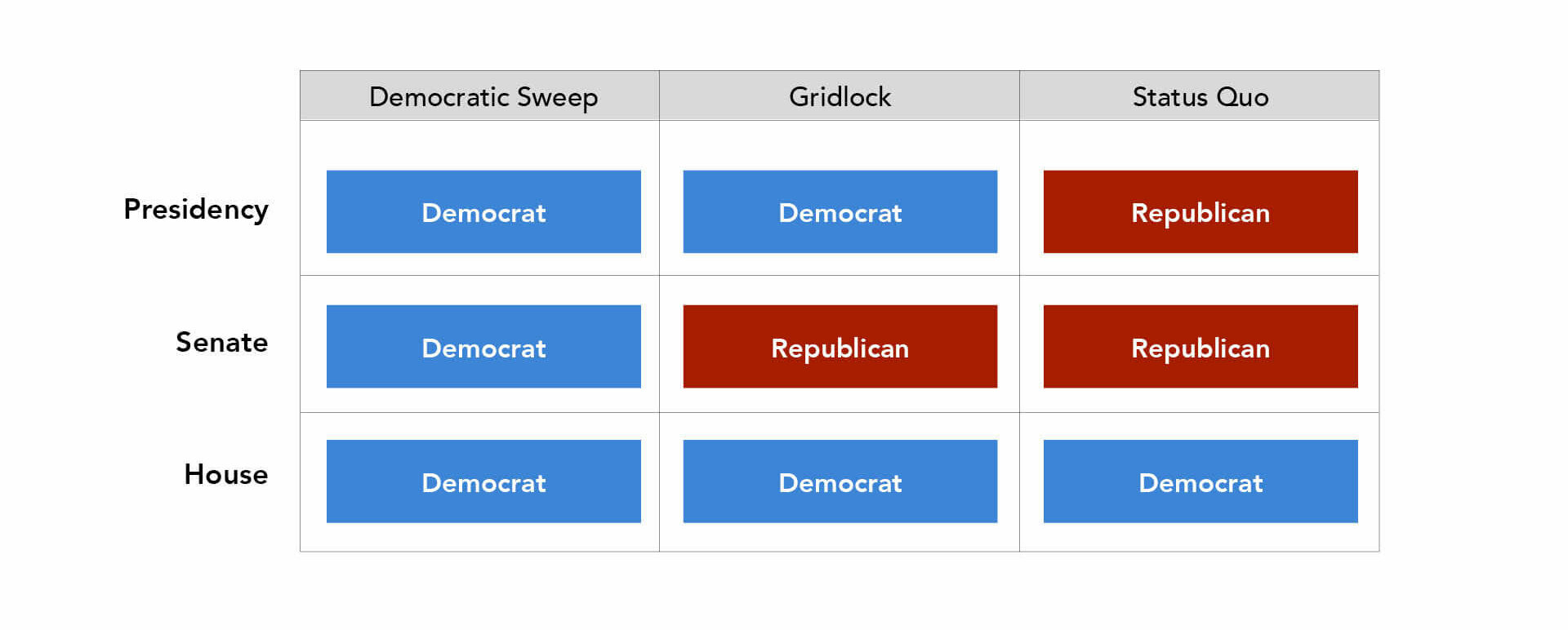

Let’s take a look at the three most likely scenarios (in no particular order):

Each of these scenarios bring different ramifications on U.S. policy such as trade, tax, and environmental issues. However, for the purposes of our conversation today, we’re going to focus specifically on the election’s potential impact on the markets and investing.

No doubt, the 2020 election is already one of the most contentious elections in modern memory. So, let’s look to history to see what wisdom we might be able to glean.

Imagine you had invested $10,000 in the largest 500 U.S. companies (represented by the S&P 500 Index) in 1933. Let’s take a look at the chart below to see how that investment would have grown:

In every period but one, we see significantly positive growth. In fact, had you invested $10,000 in 1933, you would be walking away with $136,885,882 today (“today” being June 30, 2020).

Put another way: in a little less than 90 years, your initial investment would have increased nearly fourteen-thousand times over.

The one instance where we don’t see positive growth is the span from around 2000 to 2008/2009 where the markets were hindered by both the dotcom bubble as well as the financial crisis triggered by the housing and subprime mortgage crisis (which ultimately led to the Great Recession.)

The major takeaway here is that overall long-term growth has continued regardless of which party has occupied the White House, Senate, or House.

Let’s look at this in a different way:

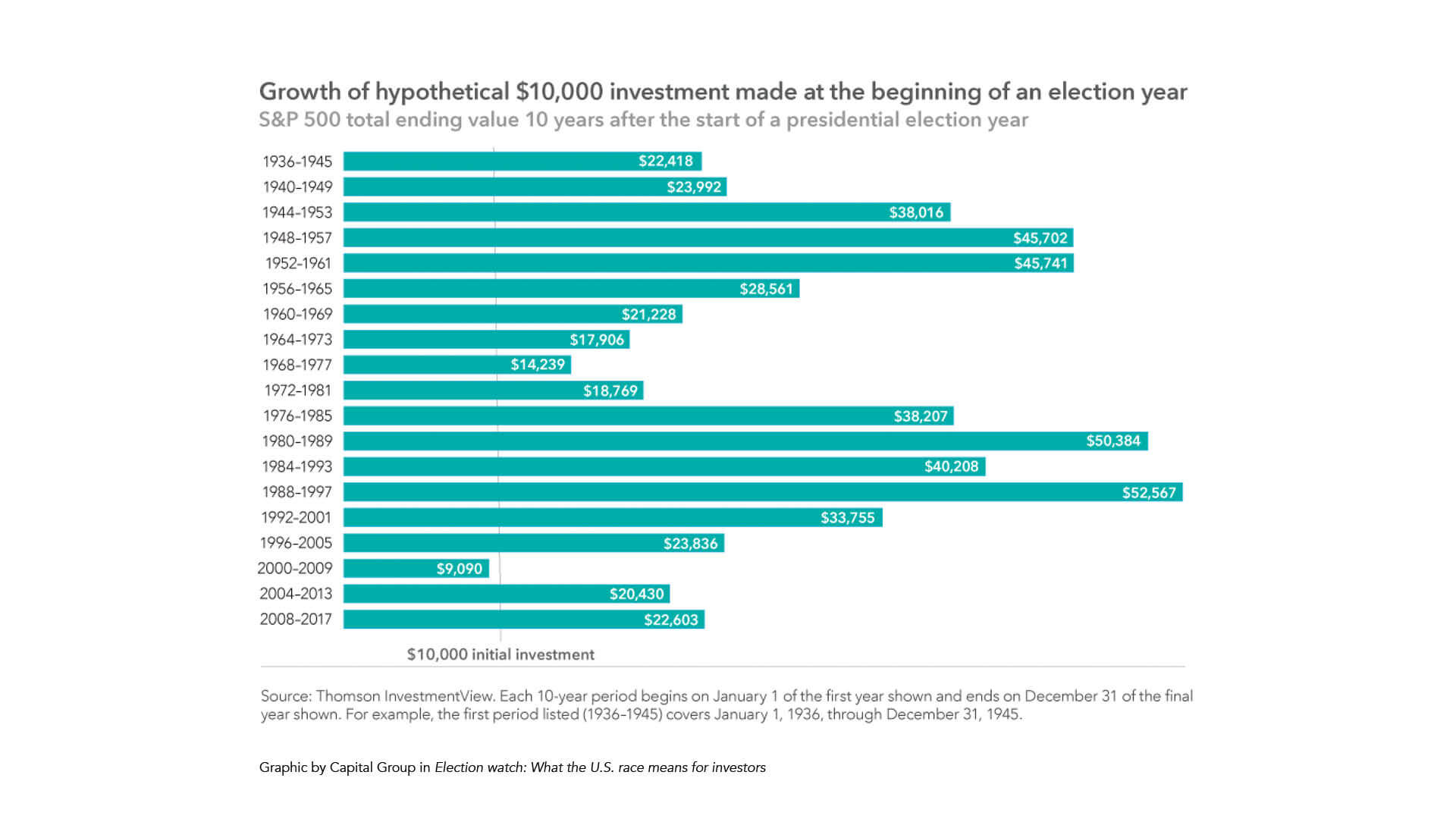

The chart above shows a hypothetical $10,000 investment made in those same 500 companies at the beginning of an election year and looking at its growth over a ten-year span of time.

The chart above shows a hypothetical $10,000 investment made in those same 500 companies at the beginning of an election year and looking at its growth over a ten-year span of time.

Again, you will see that, in all but the same time period discussed previously, your investment would have grown. In many cases, it would have grown significantly.

In reality, investor success has depended much more on sound investing strategy, investor discipline, and the transcendent strength and resiliency of the American economy than on which party has held political control.

Looking at the charts above, it quickly becomes apparent that, over time, stocks have trended higher regardless of which party has held office. It is also helpful to remember that the trends above include all major crises the United States and the world have experienced over the last 100 years, such as:

And yet, despite short-term, sometimes dramatic volatility, the market has remained remarkably resilient over the long-term.

Looking at past election cycles shows that controversy and uncertainty have surrounded every campaign. At the time, many elections were touted as (and certainly felt like) “the most important election in the history of the United States.”

In reality, investor success has depended much more on sound investing strategy, investor discipline, and the transcendent strength and resiliency of the American economy than on which party has held political control.

With the amount of information and noise fighting for our attention right now, what should we even do? Let us offer three suggestions:

News, whether verified or not, is pushed to us at a speed, volume, and in more ways than we have ever seen at any other time in the history of humanity. And while fear and anger are, unfortunately, effective at driving viewership, advertising revenue, and votes, they have also been notorious drivers of costly investing mistakes. In times like these, we often win by not losing. Don’t panic. Don’t try to predict the future. Don’t give into fear. Stay disciplined and stick to the principled investment plan strategized in your Financial LifePlan. History has shown us—and we strongly believe—that this will give you the best opportunity for long-term success.

Note: If you don’t have a Financial LifePlan, we want to help you create one! We believe that everyone should have a personalized, custom Financial LifePlan to help them align their finances around what truly matters most in life.

We’ve seen over and over again how emotional, knee-jerk decision making can lead to consequential mistakes. At LifeGuide, we manage portfolios according to our nine investment principles. We have put a lot of research, effort, and our best thinking into our investment management process that includes strategies such as bucketing, asset allocation, dynamic rebalancing, and our Buy the Dip/ Sell the Recovery Progressions.

It is not easy to maintain perspective when managing your own money. This is especially true when times feel scary or stressful. Talking with a professional who has your best interest at heart can provide guidance to help sort through the noise, make wise decisions, and avoid costly mistakes based on emotion, incomplete data, or personal biases.

A parting thought from Doug:

While I have great confidence in research, analysis, and the effectiveness of sound investing strategies consistently executed over time, I find it helpful, as a person of faith, to be reminded of who is ultimately in control.

I find hope and peace in knowing that God is good and has power over global pandemics, violence, divisiveness, international conflict, and natural disasters. I find hope and peace in knowing that He is in total control no matter which party occupies the White House or Congress.

Here are two verses that I’ve found particularly meaningful during times such as these:

— Jeremiah 29:11 (NIV)

— Matthew 6:25-34 (NIV)

Remembering these words gives me a quiet confidence that helps me maintain a proper perspective—one that I try to share with others who cross my path. I encourage you to lean on this truth as well, especially in the months ahead, which are sure to get even crazier.

So, when times feel chaotic, and fear or uncertainty start to creep in, remember: we know how the story ultimately ends. God is all powerful and He’s got this!

In calm confidence,

– Doug