July 11, 2024 | Investing

Zak Lutz here, partner and Chief Investment Officer at LifeGuide.

Today, I want to share Part 2 of our two-part mini-series on how we manage portfolios in “up and down” markets.

In Part 1, we talked about how we proactively prepare for ups and downs rather than trying to predict exactly what will happen next—primarily through diversification and our bucketing strategy. Today, I want to explore how we attempt to take advantage of the market’s ups and downs after they happen through dynamic rebalancing and our BDP & SRP strategy.

Let’s jump in!

Note: This video was originally produced for our monthly client newsletter, Guidepost.

Before jumping in, I want to be clear: Neither we nor anyone else can predict what will happen in the markets. Please, BEWARE of anyone who claims otherwise; no one can predict the future. Therefore, we do not try to time the market, which means we can’t sidestep the next market drop. Additionally, while the strategies we employ are useful tools, they can never guarantee a result or protect against a loss.

Strategy 1: Dynamic Rebalancing

![]()

The first way we can take advantage of the markets’ ups and downs is through dynamic rebalancing. We employ dynamic rebalancing for clients at all asset levels.

With an intentionally diversified portfolio (intentionally being the keyword here), we start with a desired percentage in each portfolio holding. Over time, the different parts of a portfolio go up and down at different rates. This causes some holdings to drift from their desired percentages, ultimately changing the desired risk and return targets.

To fix this, we can “rebalance” by selling what has become too large a percentage and buying what has become too small a percentage of the portfolio.

While it’s not uncommon to rebalance portfolios on a set schedule (say, every 12 months), our dynamic rebalancing approach monitors client portfolio holdings every week and rebalances when the percentages drift outside of predefined targets as spelled out in their specific Financial LifePlans.

Buying low and selling high is a big part of the equation for investor success. During market declines, when stocks drop, dynamic rebalancing allows us to purchase more stocks when they’ve become too small a portion of the portfolio relative to the other holdings in a client’s account. Likewise, dynamic rebalancing also allows us to keep target allocations in alignment by selling off excess stocks when stock prices go up and become too large a portion of a client’s portfolio.

Strategy 2: BDP & SRP

![]()

The second way we can take advantage of the markets’ ups and downs is through our BDP & SRP strategy.

BDP & SRP stands for “Buy the Dip and Sell the Recovery Progression.” This is a contrarian investment strategy we employ for clients with more than $450,000 of assets under our direct management.

Just like with dynamic rebalancing, buying low and selling high is the name of the game.

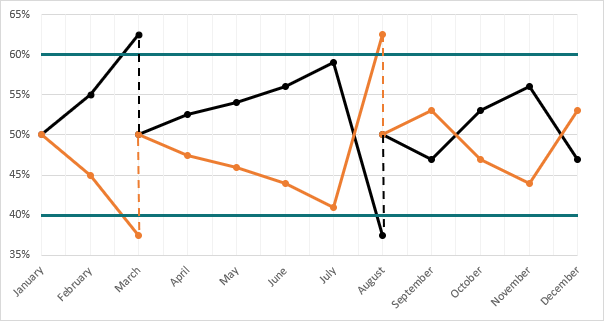

As a contrarian strategy, BDP and SRP attempt to do the opposite of what the masses are doing and embrace the natural growth and contraction cycles stocks regularly go through. (You might have heard of terms for these cycles, such as bull and bear markets, pullbacks, and corrections.)

While the specifics will vary according to each client’s Financial LifePlan, broadly speaking, the BDP or “Buy the Dip” part of this strategy involves buying more stocks after they have declined in value while the majority of investors are doing the opposite (i.e., selling). Why do we do this? Because stocks are essentially on sale during market dips!

After the markets have recovered and the majority of investors are buying again, the SRP or “Sell the Recovery” part of the strategy kicks in, where we sell off the extra stocks we purchased—hopefully now at a profit.

Beyond buying low and selling high, BDP and SRP strategy also addresses some common investor challenges.

For one, it can be really hard to know when to buy during a dip. No one knows how far the market will go down during one of these cycles or how long it will take to recover. So, our BDP strategy is designed to be progression-based. This means that, during a drop, we buy a little at a time to take advantage of the current reduction in stock prices should the markets turn around. And, if stocks go down further, we’re set up to buy more at an even bigger discount in the future.

Our BDP & SRP strategy is also intended to help clients avoid the pitfalls of emotional investing by laying out a clearly defined game plan ahead of time. We know it can feel pretty intimidating doing the opposite of what the masses are doing, so having a clearly defined plan and strategy in place ahead of time can help offset this natural anxiety and prepare them to take advantage of the next market drop!